Carbon filtering is the technique whereby activated carbons remove impurities and contaminants from the air with the process of chemical absorption. It is done through an activated carbon bed and is also used during water treatment. Carbon filters help to remove dirt, dust, microorganisms from the air. There are various applications of such filters in the realm of the industrial sector and medical sector. People suffering from breathing issues, use carbon filters to filter the air. There are various kinds of filters available in the market and each has its pros and cons.

There’s been discussion regarding carbon filters providing health benefits at all. The activated charcoal or carbon filters the air and many indoor air pollutants are eliminated. They include gas, chemicals, dust, dirt and bad odour. It can also remove pet odour from indoors. People suffering from ailments like asthma, allergy, cancer or heart diseases find it very useful.

The Purpose of Using Carbon Filter

The efficacy of carbon filter relies on the kind of carbon filter you are using and other factors. But, the primary function is to remove organic chemicals and volatile chemicals from the surrounding. It may also remove herbicides, pesticides, benzene and other compounds. Everything that interferes with breathing can be eliminated from the surrounding air. You may now wonder how it benefits the health. Yes! Carbon filter does benefit your health. It helps in air pollution control. Any disease you are suffering from is the result of years of toxic build up. Air pollutants cause a variety of issues. The problems may be short term or long term. It is important to breathe in clean and pure air. Vapour-based pollutants can be got rid of quite easily. If the air is not clean, our bodies absorb the pollutants, and this will cause the body cells to die slowly and gradually.

Prevent A Range of Health Problems

The use of carbon filters can help to avoid several health problems. This is all due to the charcoal air filter and carbon. Quality carbon filters attract pollutants and get rid of it from the air. In the end, you will have no allergy. Buy a good quality air filtration system for the home and office. After having purchased carbon filter, replacement of filter will be needed quite often. Charcoal absorbs pollutants from the air and so the filter may get saturated with pollutants. If the filter is not clean, it won’t serve its purpose.

Cheap Carbon Filter Online

For the sake of disease prevention, you may buy cheap carbon filter online. Look for a trustworthy and reliable brand of the carbon filter. Best quality carbon air purifier can benefit your health immensely. It also helps to avoid premature ageing. Carbon air filter is powerful and helps to safeguard health by preventing illness of any kind. Consider the size of your home in square footage before choosing an air filtration system.

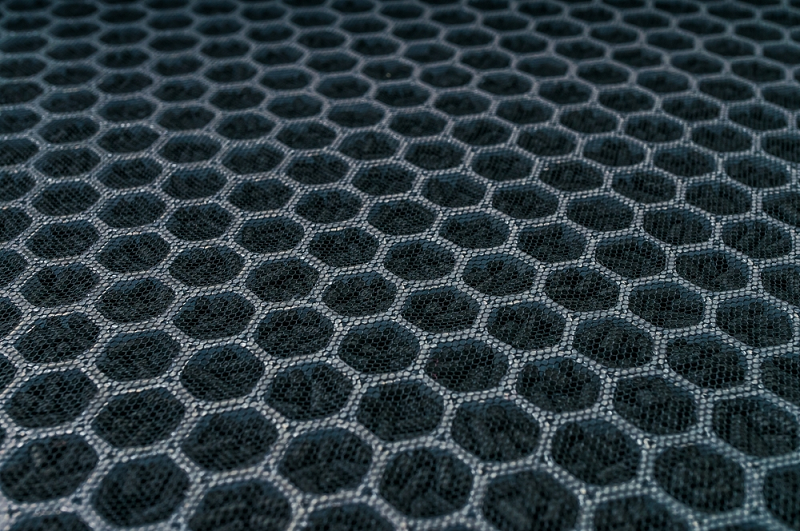

Carbon Filters

HEPA Certified Air Filtration System

HEPA stands for High-Efficiency Particulate Air. This technology became prominent during 2nd World War and could remove radioactive dust or dust of harmful nature from the air. Nowadays, homes and offices make use of air filtration systems that can remove dust, dirt and microorganisms. You can remove pollen, mould spores and several particulates. You may buy a HEPA certified filtration system for indoor usage.

There are several kinds of air filters you may find in the market. They include HEPA air filters, Ionic Air Filter, Activated carbon filters and others. The choice of filter depends on your needs and the area where you use.

You must be logged in to post a comment Login